payment plan for mississippi state taxes

Taxpayer Access Point Payment. 12 month installment plan.

How Do State And Local Individual Income Taxes Work Tax Policy Center

The payor may deduct from Mississippi taxable income the amount of any payments made under a MPACT prepaid tuition contract in the tax year.

. Box 23050 Jackson MS 39225-3050. Every individual taxpayer who does not have at least eighty percent 80 of hisher annual tax liability prepaid through withholding must make estimated tax payments if hisher annual tax liability exceeds two hundred dollars 200. Free Consult 30 Second Quote.

How much you will receive depends on your income. You will receive the full stimulus check amount of 1200 if you made less than 75000 as an individual or 112500 as a head of household. If you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penalty.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. Mississippis State Tax Payment Plan or Installment Agreement. This website provides information about the various taxes administered access to online filing and forms.

MSU offers two payment plan options. There are several options available when making a payment to your student account. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income.

If you make a non-qualified withdrawal however the earnings portion will be taxable to a resident recipient and the contribution portion that was previously deducted will be included in the resident recipients. Each semesters fees will be divided into 5 monthly auto-draft payments. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck.

Ad End IRS State Tax Problems. Mississippis State Tax Payment Plan or Installment Agreement. Estimated tax payments must not be less than 80 of the annual income tax liability.

The city of Jackson Mississippis state. E-Check is an easy and secure method allows you to pay your individual income taxes by bank draft. Parents will also receive an additional 500 for each.

It is the same everywhere in the state with a few exceptions. You will be taxed 3 on any earnings between 2001. A downloadable PDF list of all available Individual Income Tax Forms.

The first payment for Spring will auto-draft in January. And you ARE NOT ENCLOSING A PAYMENT then use this address. Box 5328 Mississippi State MS 39762.

Is there a Mississippi income tax deduction. There is an additional convenience fee to pay through the msgov portal. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

Payments will auto-draft on the first of each month beginning in August and ending in December for Fall. However the taxpayer must consider other alternatives as an installment agreement does carry interest. Payment plans may not be for longer than 60 months and the minimum monthly payment is 25.

Non-refundable enrollment fee of 7500 is due at the time the plan is established. These adjustments should be reported on page 2 of the resident and non-resident forms Payments to an IRA You may deduct payments to an IRA to the extent that such payments are deductible for federal income tax purposes. All other income tax returns P.

True for state income tax purposes. What you contribute up to 10000 for a single return or 20000 for a joint return during a tax year is. If you are receiving a refund PO.

Department of the Treasury Internal Revenue Service Austin TX 73301-0002. Box 1214 Charlotte NC 28201-1214. The following convenience fees will be charged to your account for processing.

Taxpayers who find themselves financially unable to pay their outstanding tax bill in full may have the option of completing an installment agreement. Internal Revenue Service PO. And you ARE ENCLOSING A PAYMENT then use this address.

The state sales tax rate in Mississippi is 7. If you live in MISSISSIPPI. Mississippi is one of just a few states to apply sales taxes to groceries.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. The Mississippi Department of Revenue allows residents to apply for an installment agreement if their tax. However if you owe Taxes and dont pay.

Please note that your payment will be postmarked the date you submit payment. Department of Revenue - State Tax Forms. Married couples who filed their taxes jointly and made less than 150000 will receive 2400.

Pay online using a creditdebit card or e-check see links below for instructions Mail a check to Account Services PO. Visit one of the Cashier windows located in Account Services in Garner Hall on the Starkville campus. And you are filing a Form.

There is an additional 1 tax in Jackson the state capital. Income Tax Estimate Payments. There is no fee.

The Department of Revenue is responsible for titling. Earnings from MPACT are exempt from federal and state income tax when paid to a school by MPACT. Affordable Reliable Services.

When a Mississippi taxpayer cannot pay off their taxes in certain cases a taxpayer can set up an installment agreement with the Mississippi Department of Revenue. Box 23058 Jackson MS 39225-3058. Use the worksheet in your federal income tax instructions to.

6 month installment plan. Get Your Free Qualfication Analysis With No Obligation. Ad Pay Your Taxes Bill Online with doxo.

You can make Estimate Payments through TAP. Mississippis State Tax Payment Plan or Installment Agreement. How to Make a Credit Card Payment.

Payment in full required no payment plan available. However prescription drugs are exempt from the sales tax in Mississippi. Income below 3000 is not taxed at the state level.

Individuals and businesses can apply. This is the rate collected across the state with one exception. Non-qualified withdrawals may be subject to federal and state taxes and a 10 federal tax.

You will be taxed 3 on any earnings between 3000 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. There is a single statewide sales tax of 7 in Mississippi. Box 23050 Jackson MS 39225-3050.

Open Bankruptcy case or openpending State court case. 9 month installment plan. Welcome to The Mississippi Department of Revenue.

Mississippi Tax QuickPay Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. Mississippi does not have some of the tax credits common to other states such as the Earned Income Tax Credit or the Child and Dependent Care Tax Credit. Pay by credit card or e-check.

There are several remedies available to help you deal with your back taxes owed. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021. Select Make an Estimated Payment from the left hand menu.

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money

Tax Friendly States For Retirees Best Places To Pay The Least

Tax Friendly States For Retirees Best Places To Pay The Least

Do I Have To File State Taxes H R Block

How Do State And Local Sales Taxes Work Tax Policy Center

Federal Income Tax Deadline In 2022 Smartasset

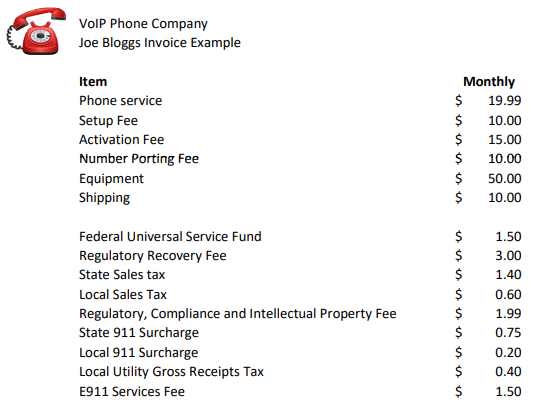

Voip Pricing Taxes And Regulatory Fees Explained

Can Mississippi Republicans Finally Deliver On Income Tax Elimination In 2022 Mississippi Politics And News Y All Politics

Mississippi Sales Tax Small Business Guide Truic

Mississippi State Tax H R Block

How Do State And Local Sales Taxes Work Tax Policy Center

Mississippi State Tax Payment Plan Details

States With Highest And Lowest Sales Tax Rates

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Mississippi Tax Rate H R Block

How Many People Pay The Top Rate Of Income Tax Tax The Guardian