net operating working capital turnover

Net operating working capital NOWC is the difference between a companys current assets and current non-interest bearing current liabilities. This means that XYZ Companys working capital turnover.

Working Capital Turnover Ratio Meaning Formula And Example

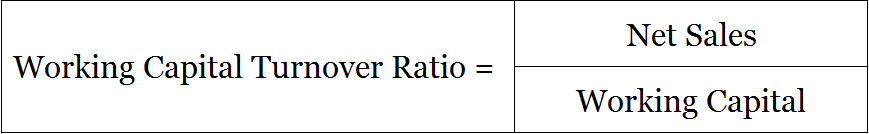

The working capital turnover ratio is calculated as follows.

. A companys working capital turnover ratio can be negative when a companys current liabilities exceed its current assets. Revenue-Based Financing provides company with working capital in exchange for a percentage of future monthly revenue. The working capital turnover ratio is a measure.

150000 divided by 75000 2. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales. Once you know your working capital amount divide your net sales.

The working capital turnover refers to a companys ability to convert its short term assets into cash to fund business operations. The formula to determine the companys working capital turnover ratio is as follows. The working capital turnover compares a companys net sales to its net working capital NWC in an effort to gauge its operating efficiency.

Net annual sales divided by the average amount of working capital during the same year. How to Calculate Working Capital Turnover. The working capital turnover ratio is an effective way that.

The net operating working capital or NOWC is the value in excess of a companys operating current assets over the operating current liabilities. 0 people shared the story. How to Calculate Operating Working Capital Step-by-Step The traditional textbook definition of working capital refers to a companys current assets minus its current liabilities.

Operating current assets are. Net Operating Working Capital Turnover Net operating working capital is equal to from ACCOUNT MISC at University of National Development Veteran Yogyakarta. Making adjustments such as.

Working Capital Turnover Ratio. Working capital is current assets minus. You can monitor the Working Capital Turnover Ratio to make sure you.

If your organization has 500000 in current assets and 300000 in total current liabilities your working capital is 200000. Working Capital Turnover Ratio is used to determine the relationship between net sales and working capital of a business. 5 Vines About net working capital turnover That You Need to See.

In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Example of Working Capital. Published October 12 2015.

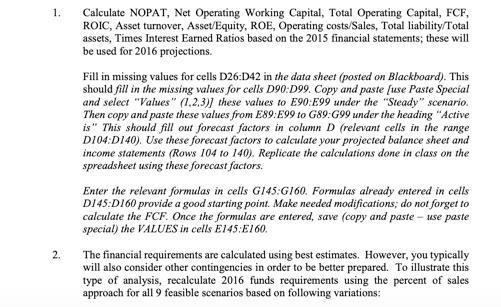

Calculate Nopat Net Operating Working Capital Total Chegg Com

Operating Working Capital Formula And Calculator Step By Step

What Is Working Capital Turnover Ratio Accounting Hub

Working Capital Turnover Ratio Different Examples With Advantages

Determinants Of Firms Working Capital Panel Evidence From Listed East African Manufacturing Companies Semantic Scholar

Working Capital Turnover Ratio Meaning Formula Calculation

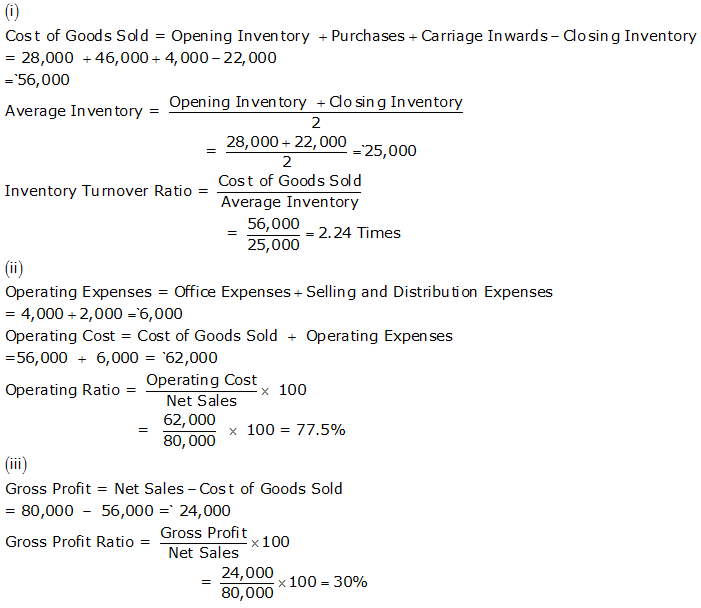

In Question 141 How To Find Working Capital Turnover Ratio Ts Grewal Accountancy Topperlearning Com

Working Capital Turnover Ratio Double Entry Bookkeeping

Prepare A Common Size Balance Sheet Of Kj Ltd From The Following Information Particularsnote No 31 3 2017 Rs 31 3 2016 Rs I Equity And Liabilities 1 Shareholder S Funds 8 00 000 4 00 000 2 Non Current Liabilites 5 00 000

How To Calculate Working Capital Turnover Ratio Flow Capital

Accounts Payable Turnover Ration Definition Calculation Tipalti

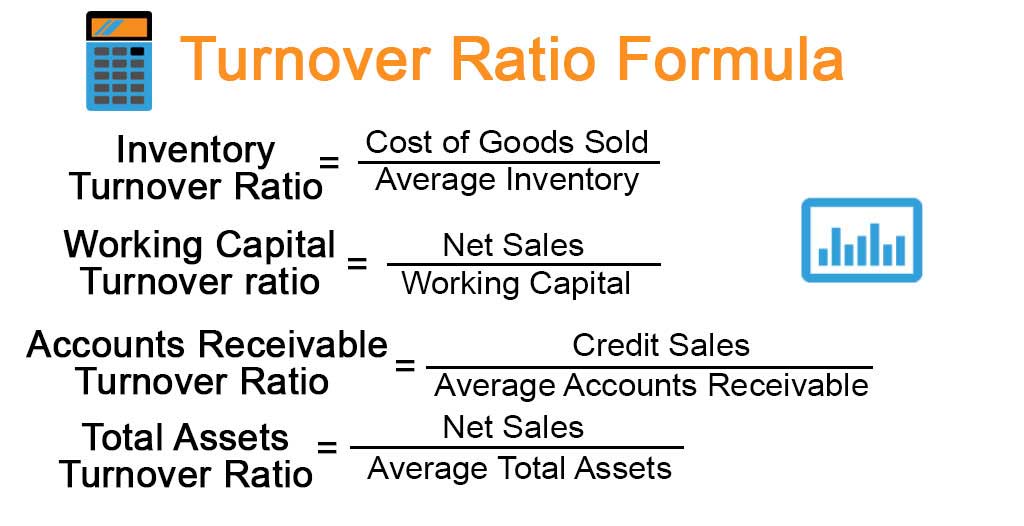

Turnover Ratio Formula Example With Excel Template

Dr Marie Bani Khalid Dr Mari E Banikhaled Ppt Download

What Is Working Capital Turnover Ratio Accounting Capital

Ratio Analysis Of Bmw Pdf Revenue Equity Finance

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Financing What It Is And How To Get It

Working Capital Turnover Ratio Different Examples With Advantages